New Homes Just Became the Bargain

Min 1

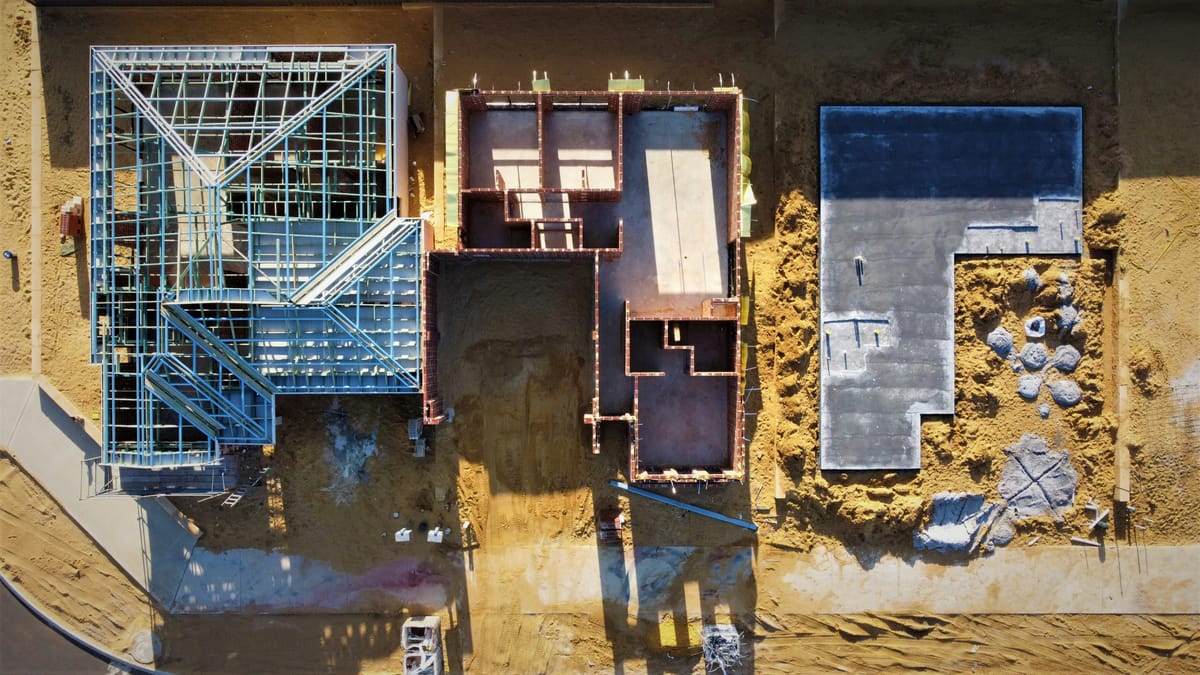

The math doesn't make sense until you see it happening in real time. A brand new three-bedroom house in suburban Phoenix sold for nearly $404k in December while a comparable existing home three streets over listed at about $422k. The new construction came with warranties, modern systems, and zero maintenance issues. The used house needed a roof in five years and had 15-year-old appliances.

Yet the new house cost $18k less.

This price inversion has only happened two or three times in the past several decades, according to the National Association of Home Builders. Typically, new construction carries a premium of around 12% to 15% over existing homes. Buyers pay extra for newer systems, modern layouts, and that new-house smell.

But right now in early 2026, builders are so desperate to move inventory that they're undercutting the existing home market. If you're shopping for a house, this creates a rare window where you can buy new for less than used—and pocket the difference.

Min 2

Builders started slashing prices aggressively in late 2025 and haven't stopped. About 40% of builders cut prices in December, with average reductions around 5%, according to National Association of Home Builders economist Robert Dietz. Nearly two-thirds are offering additional incentives on top of price cuts.

The most common? Mortgage rate buydowns. Builders use their financial resources to lower your mortgage rate for the first two or three years. Instead of paying the market rate around 6.3%, you might pay 4.5% during those initial years.

Here's why this matters: builders are sitting on inventory they need to clear. They started construction 18 to 24 months ago when they thought demand would stay hot. Now they're competing against existing homeowners who refuse to sell because they're locked into rates below 4%.

The investor payoff? You're capturing builder desperation at the exact moment when existing homeowners have pricing power. One Atlanta buyer purchased a new construction home for $385k with a builder rate buydown to 5.2%. Comparable existing homes in the neighborhood were listing at $410k with buyers paying full market rates above 6%. That's $25k in savings plus lower financing costs for three years.

Min 3

The dollar advantage compounds when you factor in the hidden costs of existing homes. That Phoenix new construction at $404k comes with 10-year structural warranties and brand new HVAC systems that won't need replacement for 15 years. The existing home at $422k needs approximately $18k in deferred maintenance over the next five years—new roof, aging water heater, HVAC system at end of life.

Total cost of ownership over five years? The new home runs $404k plus minimal maintenance. The existing home costs $422k plus $18k in repairs, totaling $440k. That's a $36k difference in favor of buying new.

Scale this across your investment portfolio and the numbers get dramatic. If you're buying three rental properties, choosing new construction over existing homes saves $109,800 in total cost of ownership over five years. Compare that to stock market returns of around 8% annually, and real estate is delivering immediate cost savings plus property appreciation.

But here's what most buyers miss: builders are also constructing smaller homes to hit lower price points. The median new home shrunk from 1,970 square feet in 2020 to 1,852 square feet in 2025, according to Federal Reserve data. You're getting less house, but at a price point that makes ownership accessible.

Min 4

Small buyers are winning because they can move fast while existing homeowners stay frozen. One couple in Columbus, Ohio tracked new construction projects in their target neighborhood and noticed builders dropping prices every few weeks. When a builder offered a four-bedroom new build at $362k—below the $385k existing homes were asking—they locked the contract within 48 hours.

Three months later, that same builder's next phase started at $378k. The couple captured $16k in appreciation before their house was even finished.

Large institutional investors? They're still analyzing. They run committee meetings. They model scenarios. By the time they decide to move, the pricing advantage evaporates.

Here's your edge: this window stays open through spring 2026 at most. Dietz forecasts new construction starts will remain weak in 2026, potentially the slowest since before the pandemic. That means current inventory represents your best shot. Once builders clear their backlog, they'll pull back on incentives and the price gap will close.

The risk? If the economy weakens or mortgage rates spike above 7%, those builder incentives might expand even further. But betting on that means betting against current trends showing stabilization. Most economists put the probability of significant rate increases below 25%.

Min 5

This price inversion hands average buyers the same opportunity that typically only exists during housing crashes—except without the economic devastation. You don't need to wait for foreclosures or distressed sales. You're simply buying at a moment when builders need to move inventory more than they need to protect margins.

New construction homes in Raleigh, North Carolina sold for around $415k in November with builder rate buydowns to 5.5%. Existing comparable homes were asking $438k with buyers paying 6.3% rates. If you bought new instead of existing, you'd save $23k upfront and approximately $8,400 in interest over three years—$31,400 in total savings. Compare that to a $200k stock portfolio gaining $16k during the same period.

The democratization extends beyond single purchases into how you build wealth. Large investment funds prefer existing properties with immediate cash flow. You can profit from new construction that won't generate rent for 90 days because you're not answering to limited partners demanding instant returns. That patience captures the pricing advantage institutions can't access.

Takeaway

This price inversion typically reverses within 12 to 18 months as builders clear inventory and pull back on incentives. Dietz projects new home construction will remain weak through 2026, potentially the slowest year since 2019. That means current inventory represents your window.

Translation: if you're shopping for a primary residence or rental property, new construction offers better value than existing homes right now. The typical buyer saves $18k to $25k compared to existing home purchases, plus captures lower maintenance costs and builder rate buydowns.

The window for maximum advantage closes around summer 2026 when builders finish clearing their backlog. Buy in the next 120 days and you're capturing peak incentives. Wait until fall and builders will have adjusted their pipelines and scaled back discounts.

Miss this entirely and you're back to paying the standard premium for new construction—that historic 12% to 15% markup returns once supply-demand balance normalizes.